Sponsored post.

If you recently switched over to an HSA health care plan, believe me, I recognize that dazed look in your eyes! That was our family this past summer! And after a half a year of learning this new system, I have learned a LOT about using an HSA. And now, via my experience and my partnership with UnitedHealthcare, I can answer your HSA questions! Here’s a few of the more common ones – some details will, of course, be specific to your group and plan.

Answering your HSA Questions!

What does HSA mean?

HSA stands for Health Savings Account. And once you learn how it works, it could be a better plan to help your family save money overall on health care costs!

What can I use an HSA for?

An HSA is a personal bank account that helps you save and pay for covered health care services and qualified medical expenses. You can only use it for expenses that are covered by your plan. If you make a mistake (like I did!) and use your HSA Debit for a NON-Approved cost, well, then you’ll need to call your plan and find out what to do!

How do I get an HSA?

Most companies now offer an HSA as an option in their health care coverage. To get an HSA plan you must sign up for a high-deductible health care plan.

Who owns the account, and how can money be deposited?

You own the account! And just like a regular bank account, you can deposit money into it; so can your employer if they are making matching contributions.

How much can I deposit per year?

Your plan will have a yearly limit for deposits. But there is no limit on how much you can accrue over time.

What happens to unused money at the end of the year?

Any unused funds get rolled over to the next year; all your money stays in the account until you spend it.

Do I pay taxes on the money in my HSA?

No! The money is tax free! In most cases, this includes the interest earned on the account as well! In my opinion, the best way to deposit money is pre-tax directly from your paycheck, otherwise, you may have more paperwork when you file your tax returns.

If this post was helpful to you, PIN IT for later or to share with a friend! If you have additional questions, ask them in the comments below and I will try to answer as best I can!

Learn more about how HSA plans can help you save money on health care costs!

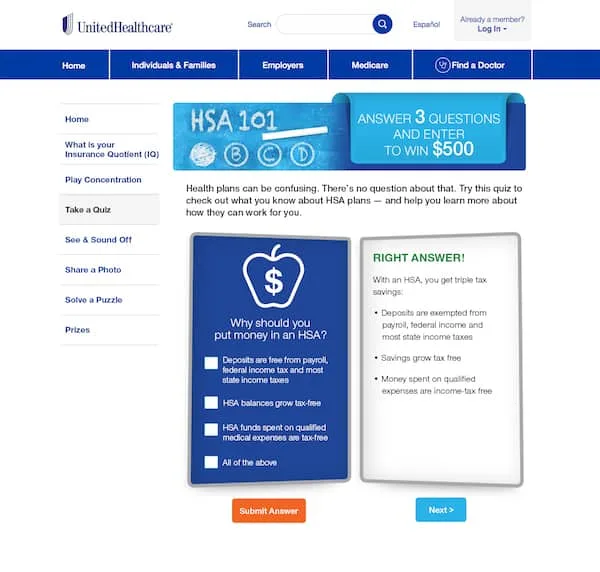

There’s a lot to learn when you’re deciding on a health care plan, or switching to an HSA. UnitedHealthcare wants you to get the most out of your plans, so they’ve created another fun quiz called HSA 101!

You just read the question, click the multiple choice answer, and submit to find out the right answer! Plus when you play HSA 101, you’re also entering to win their weekly and monthly cash prize contests!!! ($500 monthly; $100 weekly cash prizes!).

You just read the question, click the multiple choice answer, and submit to find out the right answer! Plus when you play HSA 101, you’re also entering to win their weekly and monthly cash prize contests!!! ($500 monthly; $100 weekly cash prizes!).

You can still play the Quick Care Quiz (teaches you where to get proper care) for additional chances to win the monthly and weekly prizes!

A bonus $100 giveaway just for visiting the UHC website!

UnitedHealthcare has generously provided a $100 Gift Card to Crate & Barrel as an extra prize that ONLY my blog readers can win! To enter:

Visit the UHC site and complete at least 1 engagement (which means you finish at least 1 quiz/activity and fill out the final entry form)Use this promocode on the UHC Giveaway entry form: HAPPYSTRONGHOMECome back here and enter my giveaway here!!Return DAILY to enter both my giveaway and the UHC contests!

**Note: Winners may only win ONE UHC-sponsored blog giveaway per month (among all participating bloggers).

Sponsored by UnitedHealthcare; I received compensation for sharing this message. All opinions are my own. I am not responsible for fulfilling giveaway prizes.